Daniel Schneiderman, CCTLA Member

This article is intended to be Part 3 of a 5-part series to be read from the new or aged associate’s point of view. The first section Part 1 provided a 20000-foot view of third-party bad faith strategy for the prudent associate. Part 2 which appeared in the Fall 2022 Litigator focused on the demand phases and should be considered as a continuation of Part 1. This segment Part 3 addresses the relationship of the C.C.P. Section 998 to investigation and discovery. Part 4 will discuss late-stage litigation and alternative dispute resolution. Part 5 will pertain to post-judgment discussions, potential assignment and final thoughts.

I. The Litigation Workflow

I. The Litigation Workflow

In my experience, actualized or actionable bad-faith situations stem from clear and set expectations and communications from plaintiffs’ counsel. Once those expectations and communications are ignored often repeatedly, actionable bad faith starts to take form. There is no one-size-fits-all. Each case is different. However, once in litigation, the seeds of bad faith typically grow in my experience from memorialized acts of reasonableness (i.e., conveying your case and deadlines) by plaintiff’s counsel. Despite that reality, it is not unusual for an adjuster, primary counsel, or conflict counsel to claim that you “trapped them” or “set them up” for a bad-faith lawsuit. Such claims are inevitable as this is the fundamental defense to any allegation with a standard of “reasonable” action. With that in mind, you must be prepared to substantiate your actions and the reasons for your deadlines, statutory or otherwise. In my opinion, this strategy always involves a high level of transparency and cooperation and sometimes even extensions to allow defense counsel a true and reasonable opportunity to perform.

II. Discovery and the 998

II. Discovery and the 998

For any civil attorney, let alone the illustrious prudent associate, it is vitally important to note the importance of the Code of Civil Procedure section 998 in the process of evaluating, attempting, and effectuating a resolution, especially one involving a policy limit. Written discovery and depositions (i.e., any process where each side has to say or do anything under oath with penalty of perjury) are only some of the natural junctures of a case that present opportunities to memorialize the unreasonableness of an “OPC” (i.e., opposing counsel or character). Therefore, it is important to understand the inherent relationship between basic discovery procedures (i.e., written discovery, depositions, IMEs) and your policy limit demand which [depending on the circumstances] will take the form of a Code of Civil Procedure section 998 “Offer to Compromise” once in litigation. This relationship was explained in Najera v. Huerta (2011) 191 Cal.App.4th 872, 879. In that case, the court made a determination regarding enforcement of an early expired 998. In coming to a decision to affirm the lower court’s ruling and not enforce 998-related penalties, the court referenced a dissent from Barba v. Perez (2008) 166 Cal.App.4th 445, 453. In that excerpt, the court re-stated “why it is ordinarily not reasonable to expect defendants to jam basic discovery into the 30 days following the service of a summons and complaint in order to respond to a section 998 offer… As a practical matter here is what typically has to happen within 30 days following service of a personal injury complaint upon a defendant: (1) The defendant has to deliver the summons and complaint to his insurance carrier; (2) A claims adjuster for the insurer has to review the allegations of the complaint with the insured; (3) The claims adjuster has to line up counsel for the defendant; (4) Defense counsel has to discuss the allegations of the complaint with the insured and prepare an answer.” This language is not cited as a cautionary warning regarding timing. Rather, it is intended to provide a guide as to the micro-factors a court or later a jury may consider when gauging your good-faith actions relative to the 998 and in the event of a “lid off” situation the policy limits. Make sure to consider, use, and take the next logical leaps necessary when timing your policy limit 998 around the discovery process.

III. Reasonableness of the 998

III. Reasonableness of the 998

But sending out a 998 is not enough. These interactions must be documented (i.e., highlighted through writing[s]) to preserve your client’s future leverageable options, especially those geared towards pre-trial resolution. As in any negotiation, leverage and diligence are reasonable means to accomplish a good result for your client. Any attorney that ignores those elements does so to their own and their client’s detriment. To that effect, for any defense attorney out there who would like to attempt to use such a reality against the prudent associate, I would simply advise them that the written theatre of bad faith is again focused on one thing: showing reasonable or unreasonable conduct. One way to memorialize this? Showing that your actions are effectuating the purpose of the 998, i.e., to promote early and efficient resolution of matters prior to trial. In this regard, “the policy is plain.” Section 998s are meant to encourage a settlement by “providing a strong financial disincentive to a party.” (Bank of San Pedro v. Sup.Ct. (1992) 3 Cal. 4th 797, 804, 12 CR2d 696, 700-701.) This is true despite the party status, i.e., “whether it be a plaintiff or a defendant–who fails to achieve a better result than that party could have achieved by accepting his or her opponent’s settlement offer.” (Id.) “This is the stick. The carrot is that by awarding costs to the putative settler, the statute provides a financial incentive to make reasonable settlement offers.” (See Id. [emphasis added]. See also Mesa Forest Products Inc. v. St. Paul Mercury Ins. Co. (1999) 73 Cal. App. 4th 324, 331, 86 CR2d 398, 401 [citing text].) In case it is not clear, bad-faith “strategy” is and should be focused on one question: “What is reasonable?” Depending on the circumstances, this question may arise at different stages of pre-litigation and litigation and sometimes repeatedly. Ultimately, especially when discussing the timing of 998s with a policy limit demand, it is important to treat any situation as if you are being judged by it in front of a judge and/or jury. In this specific but not exclusive manner, a reasonably timed 998 is the perfect tool to accomplish or encourage each of these goals.

IV. Timing Extensions and Repeats

IV. Timing Extensions and Repeats

A. Early 998s

Despite the statutory and legal authorities that delineate the “earliest” a 998 may be sent, there are extenuating circumstances that may affect the enforceability of an early 998. For example, if you have memorialized the steps taken with the carrier pre-litigation, such a showing may be sufficient to avoid a taxation of costs following judgment. In the event that your 998 matches the pre-litigation policy limit demand (i.e., the “last chance 998), your opposition to a motion to tax will be even more persuasive, assuming you have put this chronology in writing. In short, if you are ever asking yourself whether you have provided enough time and information to the other side, or you believe there are other extenuating circumstances that take your matter outside the limitations of the statute or authorities, make sure you commemorate that on the written record.

B. Extending 998s

There are many ways to utilize policy limit 998s to progress discovery. Consider keeping the 998 open through mediation. Send an early 998 but provide that additional extension when requested on condition that they provide in writing EXACTLY what they require to make a reasonable determination during the extended time-period. The goals here are simple: take reasonable and necessary steps to resolve the matter, i.e., do not obstruct the discovery and deposition process and get the other side the information they need to make a reasonable determination. That being said… I want to make one thing clear… again… we ARE NOT talking about “setting the other side up.” The name of the game when it comes to bad faith, what “opens the policy up,” is being in fact reasonable in action and word. This, of course, is ultimately a question for the jury, but it is shown through your reasonable action throughout litigation.

C. Lowering 998s

To that effect, reasonableness is a two-way street. If a defendant serves an unreasonably low section 998 offer based on the damages of the plaintiff, the plaintiff’s attorney may want to object to that offer, citing a lack of information about liability to be able to properly evaluate the offer. This objection should cite to the need to request more time for discovery and identify the additional information they need to evaluate the offer. Then again, the prudent associate also knows that an unreasonably low 998 can be used as a double-edged sword, especially when more unreasonably low 998s (i.e., the “I hope they take it 998s”) follow. But what happens to a plaintiff that reduces their 998 to under the policy limits? Does a 998 under the policy limits evidence unreasonableness of your previous offers? The frank answer: yes, it can have an impact… but if used appropriately with the correct memorialization of events… it shouldn’t. There are simply too many possible circumstances/combinations of what happens between prelitigation and litigation to identify a clear and concise workflow for all situations. However, to avoid the situation described above and depending on the liability facts/damages, I will often send a 998 at the top of my value range. This value may very well be in excess of the policy limits and that in of itself is obviously important. That being said, in the event your 998 drops under the policy limit, it is important to pair that with a letter clearly delineating that the 998 is being provided for the purpose of early resolution vs. reasonableness. This is especially relevant for purposes of finding a “trial 998.” When the other side has set their stakes into the ground and you have a real idea of where they want to resolve the case (assumedly at an unreasonable value), always keep the methodology of reasonableness in mind. If you are changing your valuation, express the reason for it in your paired letter. If that reason is consistent with the scope and intention of the 998 (i.e., encouraging reasonable attempts at resolution prior to trial), you can avoid any later claims that your initial 998s were unreasonable or reflected a pattern of unreasonableness.

V. Conclusion

V. Conclusion

The message of this article: find a reasonable position, document, repeat. Do so knowing that your actions will be reviewed and analyzed. Always maintain professionalism but spell out what you want and why you need it in writing. If defense says they need something, comply to the degree that is reasonable and document where required for objection or limitation. Use the Code of Civil Procedure and its deadlines as an ally and effectively combine your procedure workflows with your demand workflows.

II. Discovery and the 998

II. Discovery and the 998 III. Reasonableness of the 998

III. Reasonableness of the 998 IV. Timing Extensions and Repeats

IV. Timing Extensions and Repeats V. Conclusion

V. Conclusion Introduction

Introduction Pre-Demand Letters

Pre-Demand Letters “The Judgment-Proof Defense”

“The Judgment-Proof Defense” The Policy Limit Demand

The Policy Limit Demand Conclusion

Conclusion

In April 2019, our client was stopped on his motorcycle at a stoplight in Concord, California. When the light turned green, he entered the intersection and was suddenly struck by an elderly driver that had failed to come to a stop before the intersection.

In April 2019, our client was stopped on his motorcycle at a stoplight in Concord, California. When the light turned green, he entered the intersection and was suddenly struck by an elderly driver that had failed to come to a stop before the intersection.

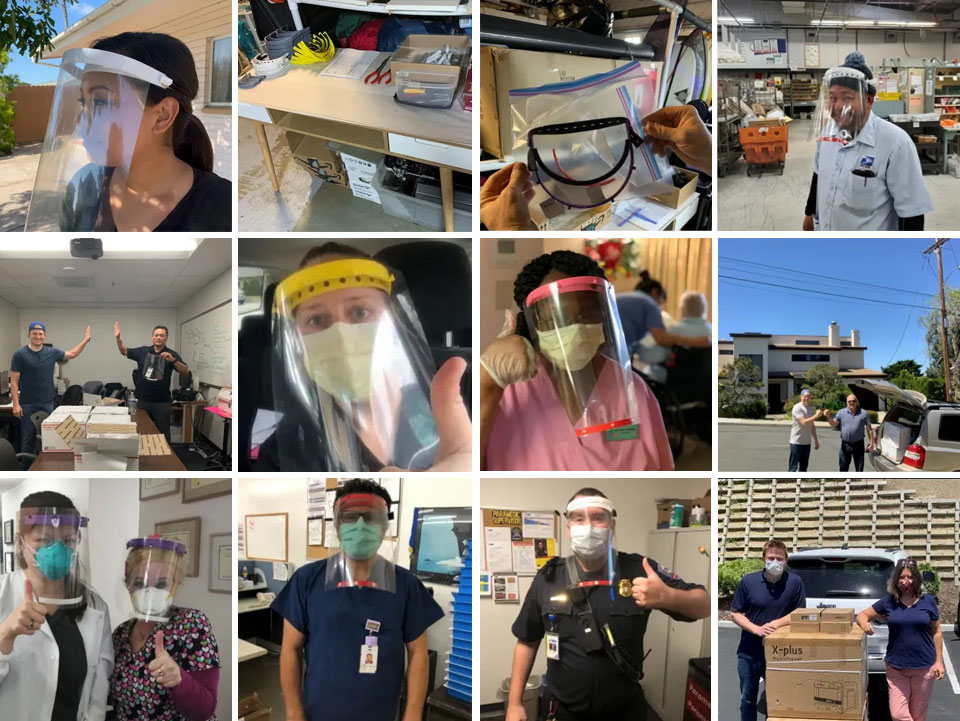

In total we got 914 shields out to first responders and hospitals across the United States and even abroad! Yesterday we completed our project. We donated the remaining $1500 in the GoFundMe account to Lincoln High School’s engineering program in San Diego. We also donated the $900 printer we used to complete the project. As a thank you to everyone who helped us, we matched the $1500 donation and purchased another $900 printer to be donated to Hoover High School’s engineering program. This pushed us right up to almost $10,000 raised in total. Thank you to everyone again for helping us with this effort. Stay safe everyone!

In total we got 914 shields out to first responders and hospitals across the United States and even abroad! Yesterday we completed our project. We donated the remaining $1500 in the GoFundMe account to Lincoln High School’s engineering program in San Diego. We also donated the $900 printer we used to complete the project. As a thank you to everyone who helped us, we matched the $1500 donation and purchased another $900 printer to be donated to Hoover High School’s engineering program. This pushed us right up to almost $10,000 raised in total. Thank you to everyone again for helping us with this effort. Stay safe everyone!